|

01.09.2025 16:37:17

|

AMINA Bank: Digital Assets Market Recap: August 2025

Market sentiment improved steadily throughout the month, fueled by expectations of a Federal Reserve rate cut in September and continued strength in U.S. equities. Risk assets broadly benefitted from Chair Jerome Powell’s Jackson Hole remarks, where he signaled growing confidence that inflation is cooling and suggested policy easing could arrive sooner rather than later.

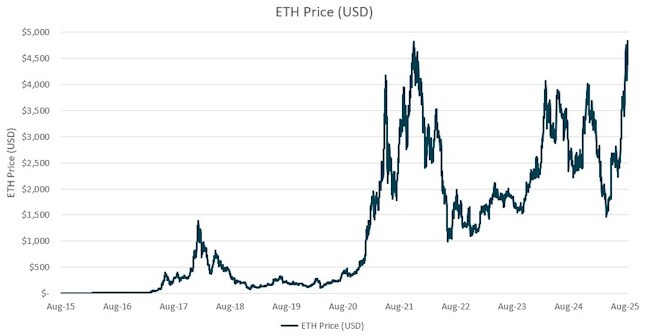

Figure 1: Ethereum Price Hits New All-Time High

Source: AMINA Bank, Glassnode

Institutional Capital Flows and Allocation Trends

ETF flows highlighted both volatility and resilience in institutional positioning. BlackRock’s iShares Bitcoin Trust (IBIT) experienced its longest outflow streak since inception but rebounded with a $63.2M inflow on August 25. The reversal helped stabilize sentiment around Bitcoin, although net flows for the month underscored that demand remains sensitive to macro conditions.

Ethereum ETFs also gained momentum following the asset’s price breakout. The launch of ETH spot ETFs in July 2024 has matured into consistent inflows, while the approval of ETH ETF options in April 2025 has further broadened institutional hedging and trading strategies. Fidelity, Grayscale, and VanEck all reported steady demand, suggesting that the ETH product suite is now fully integrated into the portfolio construction of asset managers.

Regulatory Shifts and Their Market Impact

Institutional and corporate adoption advanced meaningfully in August. MicroStrategy purchased 3,081 BTC for $357M, bringing its total holdings to 632,457 BTC, reaffirming its position as the largest corporate Bitcoin holder. Revolut secured regulatory approval from the UK Financial Conduct Authority (FCA) to expand its crypto asset services, reinforcing the role of European fintechs in driving mainstream adoption.

On the U.S. side, Coinbase saw continued growth in custody revenues linked to ETF products, while regulatory clarity around staking and stablecoins remains in progress. The SEC’s earlier approval of spot ETH ETFs and options has already set a precedent for product innovation, and discussions around additional tokenized instruments continue to surface.

Innovation, Adoption, and Ecosystem Growth

Global markets were dominated by monetary policy expectations. U.S. Treasury yields softened into month-end as traders priced in a 50% probability of a September rate cut. Equities rallied, with the S&P 500 reaching fresh highs, while gold remained stable near $2,500 per ounce, reflecting a measured risk-on environment. For crypto, this backdrop reinforced the "digital gold" narrative for Bitcoin while also catalyzing flows into higher-beta assets like Ethereum and Solana.

Forward Outlook: Opportunities and Risks Ahead

August confirmed crypto’s position as a maturing asset class integrated into institutional and corporate strategies. Bitcoin’s steady climb above $110K and Ethereum’s record-breaking $4,945 highlight the durability of this cycle’s momentum. ETF flows remain the critical barometer of institutional demand, and while volatility persists, the product suite has established crypto as a strategic allocation within traditional portfolios.Looking ahead, September will hinge on the Federal Reserve’s policy decision and the pace of ETF inflows. Both Bitcoin and Ethereum enter the month with strong technical and fundamental tailwinds, and broader market capitalization is on track to challenge $4T if momentum continues

BITCOIN KAUFEN? DAS SOLLTEN SIE JETZT WISSEN!

Was beim Einstieg wirklich zählt: Sichere Handelsplätze finden, wichtige Grundlagen und aktuelle Trends verstehen.

Jetzt informieren und fundiert in Bitcoin investierenTop Kryptowährungen

| Bitcoin | 89’240.99560 | -0.26% | Handeln |

| Vision | 0.10441 | 0.78% | Handeln |

| Ethereum | 3’266.17446 | -1.15% | Handeln |

| Ripple | 2.27264 | -0.60% | Handeln |

| Solana | 164.17087 | -2.39% | Handeln |

| Cardano | 0.63131 | -2.06% | Handeln |

| Polkadot | 3.11154 | -2.44% | Handeln |

| Chainlink | 16.75694 | -3.08% | Handeln |

| Pepe | 0.00001 | -3.19% | Handeln |

| Bonk | 0.00002 | -3.81% | Handeln |

Inside Krypto

Ob Industrie 4.0, Luxusgüter oder Internet-Infrastruktur - hier finden Sie aktuelle Anlagetrends mit vielen Hintergrundinformationen und passenden Trendaktien. Jetzt mehr lesen

Börsentag 2025: Silber vor Verdopplung? Rohstoffexperte über die Chancen

Im Experteninterview erklärt Prof. Dr. Torsten Dennin, welche Faktoren die Preise von Gold, Silber, Kupfer, Uran und Agrarrohstoffen treiben – und welche Chancen & Risiken Anleger jetzt kennen sollten.

👉 Was steckt hinter der aktuellen Gold- und Silber-Rallye?

👉 Welche Rohstoffe gelten 2025 als besonders spannend für Investments?

👉 Wie investieren Anlegerinnen und Anleger am besten in Edelmetalle & Rohstoffe?

Erhalte fundierte Einschätzungen, Marktprognosen und Antworten auf spannende Zuschauerfragen rund um Edelmetalle, Minenaktien, ETFs und Rohstofftrends.

👉🏽 Jetzt auch auf BXplus anmelden und von exklusiven Inhalten rund um Investment & Trading profitieren!